This is old news now and has been hashed back and forth in various discussion forums for the past 2 weeks. The net of the announcement is that Silver Fleet a venture capture firm purchased the controlling share of Phase One. Phase One based in Denmark, was a privately held corporation, with all the shares of stock being held as preferred or private stock. In the past it had been Phase One that was busy buying up either entire companies or purchasing a part of a company. Deals such as Phase One’s purchase of the Leaf corporation and their investment in Mamiya Corp (a Japanese based medium format company which manufactures Phase One camera bodies and lenses) and possibly Schneider Corporation. This last example is only speculation on my part, but the relationship between Phase One and Schnieder in the past 2 years has become very close since Schneider manufactures all of the Leaf Shutter lenses that Phase One sells.

Here is the link to the announcement.

I read over this announcement and then talked to a few friends of mine that are much more knowledgeable about these maters and came away with a few talking points.

No company would do this unless pressured by some force, in this case more than likely financial. By giving up 60% of the company, Phase One can no longer control it’s direction, instead only make suggestions. There is no mention about any of the company leaders being given their walking papers.

Silver Fleet’s history is not to hold on to a company for a long period of time. Phase One shows up as a company with between 55-99 total employees, so it’s not that large. I am not sure if this number includes the Phase One office in New York City and their Mellville NY location where some repair services are done.

If one reads into the announcement, it does seem to appear that Phase One’s liquidity ratio was in trouble. Here is a quote from one of the reviews about the purchase that caught my eye.

“If the report and the figures are correct then Phase One was valued at about $180 million USD / £110 million GBP, which seems incredibly low if all the previous profitability reports were to be believed. Based on figures from www.proff.dk/firma/phase-one-as/frederiksberg/fremstilling-af-optiske-instrumenter-og-fotografisk-udstyr/13477705-2/ , though their net operating profit and return on assets looked good, the liquidity ratio** did not. If true, this could explain why Phase chose to sell out sooner rather than later.

** the liquidity ratio expresses the company’s ability to meet its short-term financial obligations, and is calculated as receivables plus cash as a percentage of short-term debt.”

From reading this, it appears that Phase One may have needed this influx of cash to help pay off short term debt. Phase One’s recent roll out of the new IQ250, the first Medium Format Digital Back in existence may have created a larger debt position than Phase One was willing to accept. This could be debt to Sony corporation, who makes the chip or costs from the development and production of the new camera. However those costs should not have been that great since Phase One already had the camera back body, LCD screen, and other shared components in production with other backs.

What does this mean to a user of a Phase One camera system? (That is the real question)

After looking over this announcement and other reviews, I do take a bit of concern over this and here are some reasons.

Phase One is no longer the same Phase One corporation that I have known since early 2008. Phase One is now being run by a Venture Capital company, and their goal more than likely will not be customer driven. They are focused on only one issue, make a profit and sell the company to retain that profit level. I don’t think that Silver Fleet is interested in being a Medium Format Camera company long term.

1. What will happen to current Value Add contracts in place. The Value Add warranty is one of Phase One’s selling advantages where they extend the base warranty from one year to 5 and offer a loaner back if yours has to be serviced. In my location of Arkansas, there is no dealer closer to me than Atlanta GA, and they are not my current dealer. So if my back goes down, (which every Phase One back I have owned has done) will I be able to get it serviced? and will this new company still honor the Value Add contracts that are in place currently. Since Silver Fleet now runs Phase One, it’s anyone’s guess.

2. Will Phase One continue to develop on their current backs like the IQ260 and 280? Also will they continue to develop towards a full frame CMOS back in the 60MP to 80MP range? This will be a directive by Silver Fleet now as they own the controlling shares.

3. What about the new Phase One 645 camera? The current DF+ is pretty long in the tooth and the cost of it at $4995.00 is pretty extreme when compared to the feature set it offers.

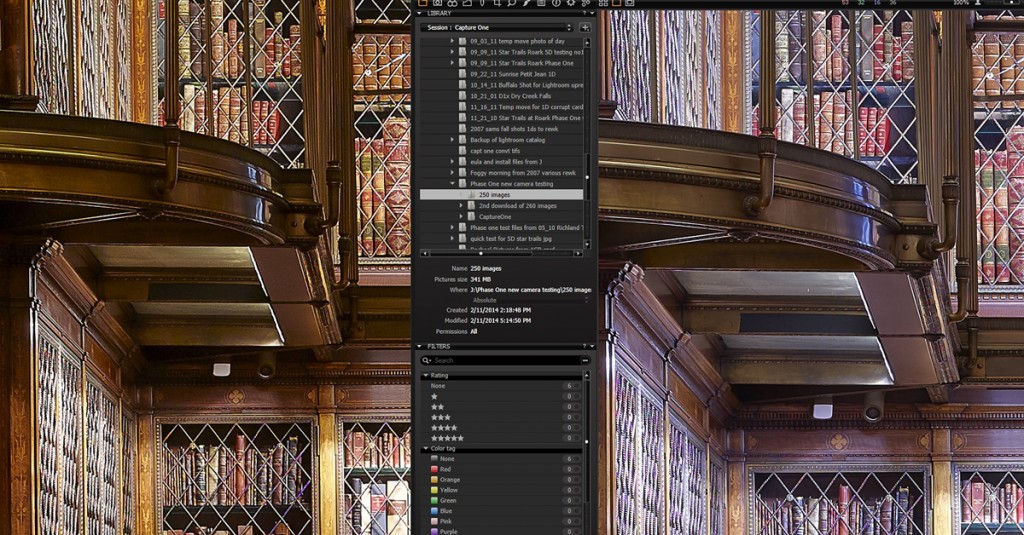

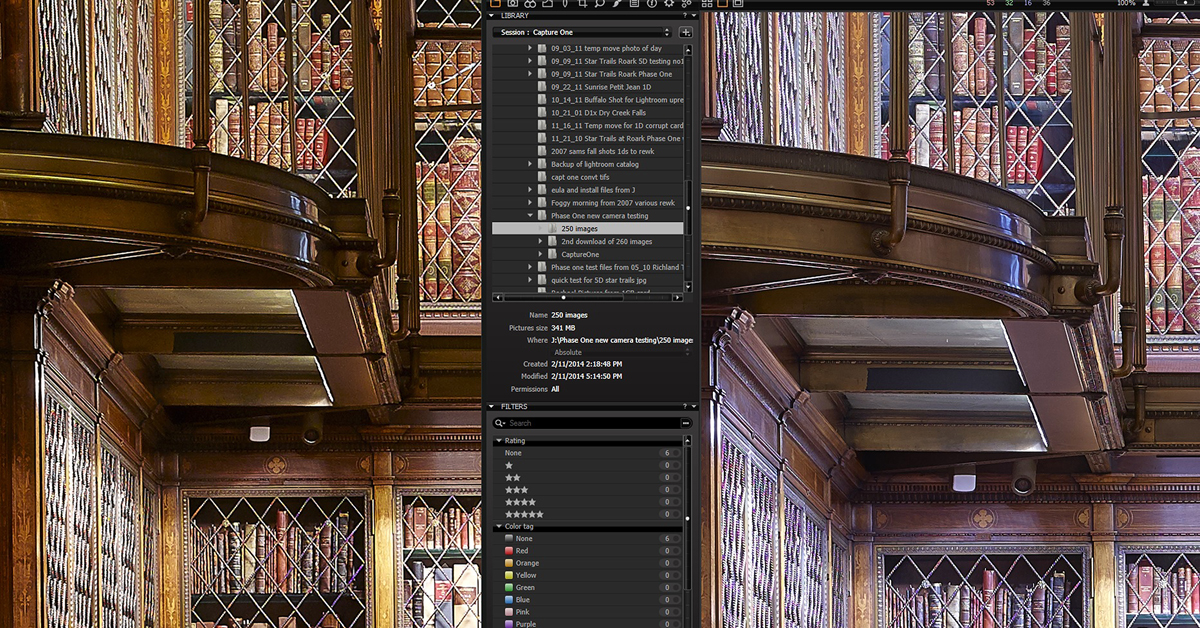

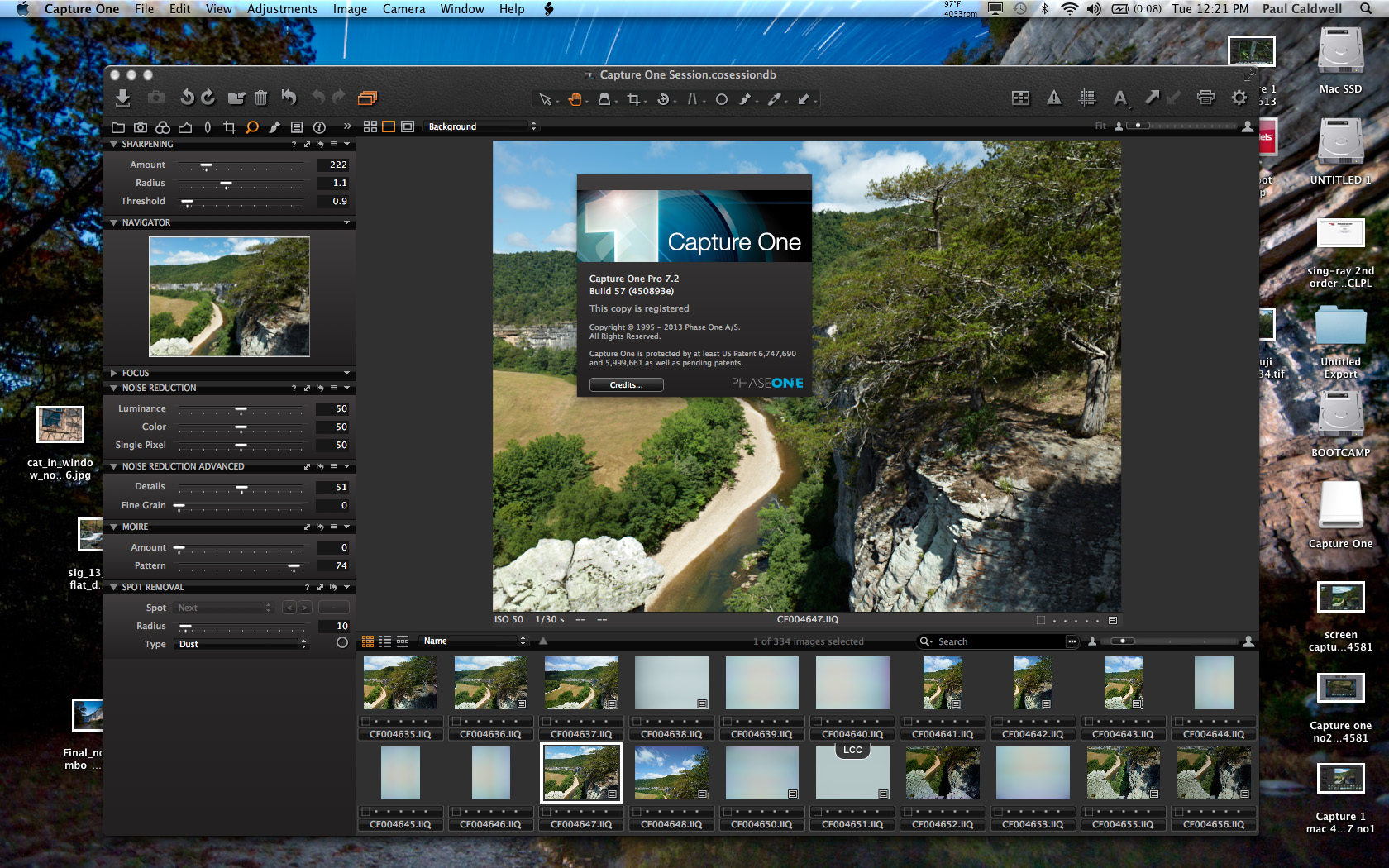

4. How will Capture One, which is Phase One’s excellent raw software and tethering solution for both Phase One cameras and other brands be effected. I feel that Capture One is one turn away from being a really excellent software platform, but the new companies direction may be to follow what most companies do and outsource the further development of the software. Or even worse sell it off.

5. Will Phase One keep it’s New York Office open, along with the Mellville service location? It seems that Phase One’s sales volumes are growing, but growing how fast. If you grew 1% over last year, you are growing, but possibly not keeping pace with your industry. I believe that Phase One’s largest customer is the far East, Japan and China. These are growing countries with a great amount of potential Due to this, Silver Fleet–Phase One may decided to close their New York offices.

You have to remember that Phase One is 90% or more dependent on their dealers for U.S. sales. Yes, Phase One has an inside sales force but in the past I have never been too impressed with this group in either follow through or product knowledge. The dealer channel in the U.S. is still pretty small but they can offer demo’s, rentals and support. In fact, the dealer channel is the primary place to go for support on a Phase One back as attempting to contact Phase One in New York, is next to impossible. This is true for either software or hardware support. Hopefully Silver Fleet–Phase One will continue to understand this and offer the same level of contacts, support and communication to their current dealer channels.

Much is still be to brought out and I am sure that it will be shown over time just what Silver Fleet is planning to do with their controlling interest of Phase One. I keep mentioning this as it’s very important to understand that Phase One is no longer Phase One, but now Silver Fleet–Phase One. Having a 40% share of a company is about the same as having 1%, you don’t have control over any decision making. Sure you can make recommendations, but that is all. Of course the other thought that comes to mind is that the select group of owners of Phase One were ready to move one, and choose Silver Fleet to make this possible. This thought continues to make me wonder what the future will bring. The only financial details that seem to stand out is that the Phase One liquidity ratio was in trouble and that definitely would effect Phase One being able to borrow to continue to develop new and existing products. This large influx of cash should cover both the outstanding debt and possibly cover new development of products.

02/15/14 News from the CP+ Show in Japan–Pentax 645DII CMOS 50MP Camera

A view of the Pentax 645D 2014 from the back showing new LCD design

CP+ the Japanese eqvilent to the U.S. CES (Consumer Electronics Show) is going on through tomorrow. and one of the highlights as far as larger camera systems goes, is the information about the upcoming Pentax (now Ricoh) 645D2014. Instead of calling it the 645DII, it seems for now that the camera will be just called the 645D 2014. Interesting name indeed.

From looking at the announcement literature by Ricoh, this will be a pretty significant camera system for Medium Format users. Here are some high points that I gleaned from the overview.

Side by side shot showing the original 645D and the new 645D 2014

Pentax first shook up the Market 5 years ago, when they first started listing a new 645D Digital camera, that would be based on the Film Pentax 645II. I was originally excited by this announcement but Pentax did little more than talk about it for several years and showed mock ups. I owned several good Pentax 645 lenses, that I was using on my Canon system with a Zork adapter, so the 645D would have been a perfect fit for me. However the long delay, pushed me to the Phase One camp and I purchased the P45+.

Pentax did finally ship the 645D about 1 year later, with a similar sensor to the one in the P45+ (it’s my understanding it’s not the exact same sensor) and they brought out basically the body with no new lenses. About 1 year before the actual ship date of the 645D, Pentax had a pretty good lineup in their primes and zooms for the 645II in the FA lenses. I had both the 35mm FA (excellent) and the 55mm FA, and had been thinking about the 35mm to 55mm zoom. Since Pentax still had a manual aperture ring on all the FA lenses, you could stop them down on other camera systems, like the Canon with a Zork adapter. However by the time the 645D shipped Pentax was no longer selling the 35mm FA in the U.S. (it’s my understanding that this lens is still sold in Japan). Also there was not much of a dealer network in the U.S. so anything that involved service would be possibly a bit of an issue. All repairs were still done in Japan, and there was only a 1 year warranty. Phase One at the time had their 3 year (now 5 year) value add warranty and I found that I preferred that type of warranty, even though the cost of the 645D was much less than the P45+.

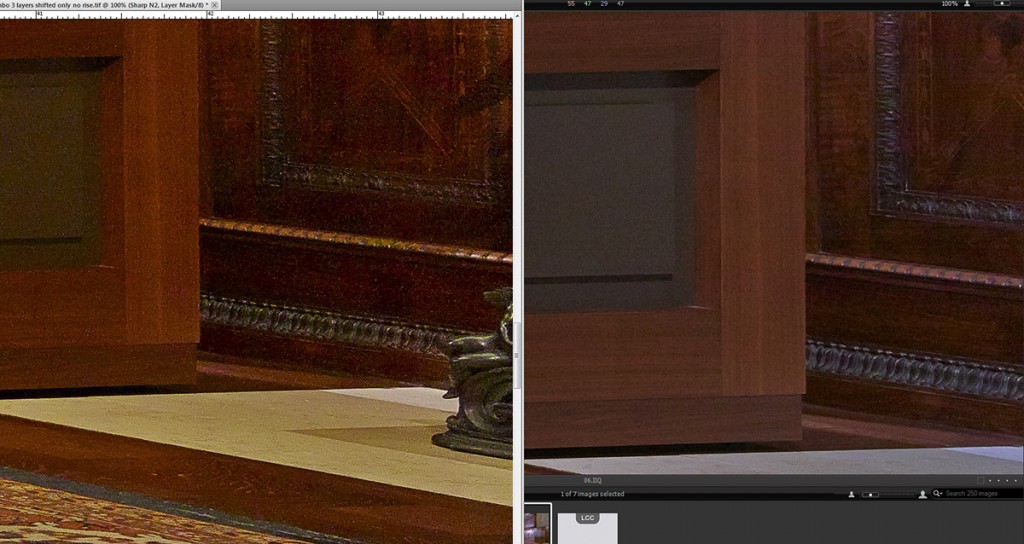

Now with the 645D 2014, Pentax is showing that they have listened to the photography market and it seems that they are bring out this new camera with some much needed refinements. For studio photographers, the lack of a tethering solution on the 645D was a big issue. I am assuming that the 645D 2014 will have tethering since it’s shipping with USB3 support. The LCD on the camera is significantly larger, has more resolution and provides more information to the photographer, not to mention it has a tilt option which allows the camera to be used at waist level (a big plus to me). The CMOS sensor should be 50MP, not a huge jump over 39MP from the first 645D, but if it’s the same sensor that’s in the Phase One IQ250 or a similar Sony design, then I think you can expect some great things from this camera. The IQ250 (see this article I wrote on the IQ250) has shown to have an amazing dynamic range and this should cross over to the 645D 2014 when it ships.

What’s key here is that Pentax ship this camera on time i.e. April of 2014. If they miss their dates and push it back then they will loose momentum and photographers will look elsewhere. I don’t think they will have any problem showing good quality images, as I don’t think this chip can take a bad picture. I also hope that Pentax steps up with their dealer support in the U.S. and possibly offers a similar program to the Phase One Value add warranty. Time will tell on this. If the price does come out at under 10K U.S, I expect that it’s possible the flood gates may be opened in the U.S. since this chip is showing to be such an excellent performer and is definitely changing the game in the world of medium format digital. One thing that Pentax does not have here in the U.S. is a strong dealer channel pushing the product to the market, and allowing demo’s for both landscape and studio shooters.

Here are two translated links that give more detailed information from the press conference at the CP+ show in Japan.

Google translation for first information from CP+ show

Google translation for Ricoh imaging new from CP+ show

I have no idea how long these links will stay up, but hopefully they are kept in good order as they contain quite a bit of details on this new exciting MF camera.